A Secret Weapon For Do I Have To List All My Assets and Debts When Filing Bankruptcy?

Clarify that you just’re legally necessary to list all your debts, which include this just one. You may want to guarantee your Buddy that you still intend to pay out them back when you could.

Chapter 11 bankruptcy is actually a lawful system for economical reorganization. It is often utilized by big and little organizations, together with people who have significant assets or debts.

Observe: some attorneys usually do not supply this “pre-filing” services. Test together with your lawyer to be sure it really is all right. (It is actually completely ok with Denbigh Regulation Centre to have your creditors Get in touch with us if you have formally retained our services.

hiding fraud to prevent the court docket from declaring a personal debt "nondischargeable" and have to be compensated just after bankruptcy.

First, Be sure that you don't leave the names of the family and friends you owe off of your bankruptcy types. You must involve them, even whenever they haven’t instructed you that you might want to shell out them back or if they told you they don’t want to be listed on the bankruptcy.

It is recommended that buyers consult with with a qualified money advisor right before taking on a consolidation bank loan.

Upsolve manufactured everyday living easier with their bankruptcy Resource. It had been fast and simple to accomplish. When you will be ready, click to find out more I extremely advocate getting started with Upsolve.

While bankruptcy regulation lets persons to address their debts With this way, creditors also have legal rights in bankruptcy. The legislation calls for folks to offer an entire list of debts when getting ready to file making sure that creditors are mindful that The cash owed to them may very well be discharged.

Karen, Ohio "This course has provided me the applications to sense self-confident in making greater options in addition to working with everyday living's setbacks."

After the courtroom has approved your disclosure assertion, your creditors vote on whether to accept the proposed reorganization program. At the very least two-thirds of your dollar amount of money or 1-fifty percent go to the website the volume of creditors should settle for the reorganization strategy for it for being accepted.

All reviewers are verified as attorneys by way of Martindale-Hubbell’s intensive legal professional databases. Only Lawyers practicing at the least a few a long time and getting a sufficient variety of assessments from non-affiliated Lawyers are suitable to receive a Rating.

Unsecured creditors stand to obtain zero repayments really should a business go out of enterprise, so they in many cases are versatile browse this site and receptive to getting a more compact sum or payment after some time in an installment settlement the functions negotiate.

Failing to recognize a creditor denies them that right. Knowingly doing so may lead to failure to discharge the debt, dismissal of the circumstance, or even legal charges.

It is common to want to select and pick the debts Discover More you involve inside a Chapter seven circumstance, but it's not authorized. You should transparently list almost everything you Go Here owe, which include obligations on your grandmother, best friend, ex-spouse, or company companion. The rule helps prevent filers from:

Michael J. Fox Then & Now!

Michael J. Fox Then & Now! Judge Reinhold Then & Now!

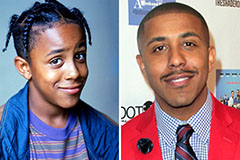

Judge Reinhold Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Melissa Joan Hart Then & Now!

Melissa Joan Hart Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now!